In today’s competitive financial landscape, effective lead generation for financial services has become the cornerstone of sustainable business growth. Financial advisors, banks, insurance companies, and fintech startups are all vying for the same pool of potential clients, making it crucial to implement sophisticated lead generation strategies that not only attract qualified prospects but also convert them into loyal customers.

The financial services industry faces unique challenges when it comes to lead generation. Unlike other sectors, financial services require building deep trust, demonstrating expertise, and navigating complex regulatory requirements while generating high-quality leads. This comprehensive guide explores proven strategies, cutting-edge technologies, and best practices for financial services lead generation that will transform your client acquisition process.

Understanding Lead Generation for Financial Services: Beyond Traditional Methods

Financial services lead generation encompasses the systematic process of identifying, attracting, and nurturing potential clients who have shown interest in financial products or services. This process involves multiple touchpoints across digital and traditional channels, requiring a sophisticated approach that combines technology, relationship-building, and compliance with industry regulations.

The modern financial services client journey is complex, often spanning several months before a decision is made. Potential clients research extensively, compare options, seek recommendations, and evaluate trust factors before engaging with a financial service provider. This extended decision-making process makes it essential for financial companies to implement comprehensive lead nurturing strategies that maintain engagement throughout the entire customer journey.

Traditional lead generation methods in financial services, such as cold calling and print advertising, are becoming less effective as consumers increasingly prefer digital interactions. Today’s successful financial services companies leverage digital lead generation techniques, content marketing, social media engagement, and advanced CRM systems to create meaningful connections with potential clients.

Digital Transformation in Financial Services Lead Generation

The digital transformation of financial services has revolutionized how companies approach lead generation. Digital channels now account for the majority of new client acquisitions, making it imperative for financial service providers to establish a strong online presence and implement sophisticated digital marketing strategies.

Search engine optimization (SEO) plays a crucial role in financial services lead generation. Potential clients frequently begin their research with Google searches for terms like “financial advisor near me,” “investment planning services,” or “business loan options.” Financial companies that optimize their websites and content for these high-intent keywords can capture qualified leads at the moment they’re actively searching for solutions.

Content marketing has emerged as a powerful lead generation tool for financial services. By creating valuable, educational content that addresses common financial concerns and questions, companies can establish thought leadership while attracting potential clients. This approach works particularly well because financial services are often complex, and clients appreciate guidance and education before making important financial decisions.

Social media platforms, particularly LinkedIn, have become essential channels for B2B financial services lead generation. Professional networks allow financial advisors and companies to connect with business owners, executives, and high-net-worth individuals who may need sophisticated financial services.

Implementing CRM Technology for Enhanced Lead Management

Modern financial services companies rely heavily on sophisticated customer relationship management (CRM) systems to optimize their lead generation efforts. A well-implemented CRM system serves as the central hub for all lead generation activities, providing valuable insights into lead behavior, preferences, and conversion patterns.

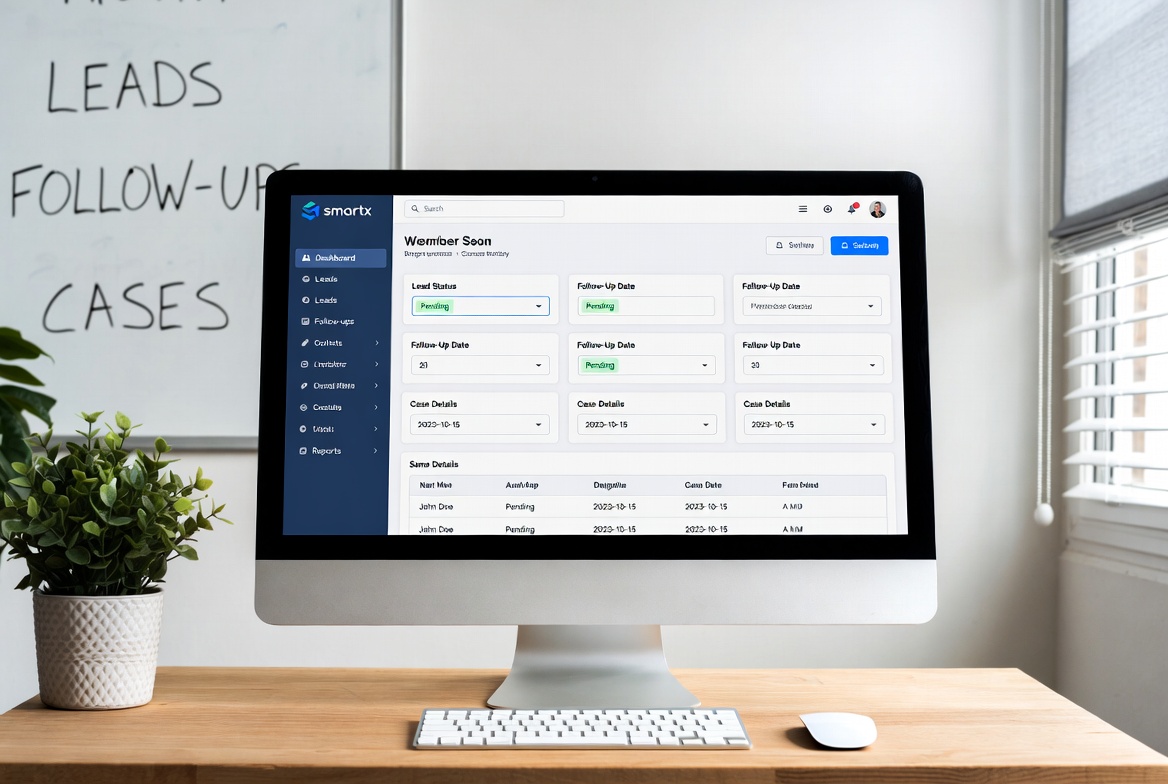

SmartXCRM’s lead management capabilities are specifically designed to address the unique needs of financial services companies. The platform offers advanced lead tracking, automated follow-up sequences, and detailed analytics that help financial advisors and companies maximize their conversion rates while maintaining compliance with industry regulations.

Effective CRM implementation for financial services lead generation includes several key components. Lead scoring algorithms help prioritize high-value prospects based on their engagement level, demographic information, and behavioral patterns. Automated follow-up systems ensure that no potential client falls through the cracks, while detailed tracking provides insights into which marketing channels and strategies produce the best results.

Integration capabilities are particularly important for financial services CRM systems. The ability to connect with various lead generation tools, marketing platforms, and compliance systems creates a seamless workflow that improves efficiency while reducing the risk of errors or missed opportunities.

Content Marketing Strategies for Financial Services Lead Generation

Content marketing represents one of the most effective strategies for generating qualified leads in the financial services sector. By creating valuable, educational content that addresses the specific needs and concerns of target audiences, financial companies can establish trust and credibility while attracting potential clients who are actively seeking information and solutions.

Educational blog posts form the foundation of successful content marketing for financial services. Topics such as retirement planning strategies, investment fundamentals, tax optimization techniques, and financial planning for major life events consistently attract high-quality traffic and generate qualified leads. The key is to create content that provides genuine value while subtly positioning your services as the solution to common financial challenges.

Video content has become increasingly important for financial services lead generation. Complex financial concepts often benefit from visual explanation, and video content tends to generate higher engagement rates than text-based content. Financial advisors who create regular video content addressing common client questions and market updates often see significant increases in lead generation and client engagement.

Webinars and virtual events represent powerful lead generation tools for financial services companies. These formats allow for in-depth education while creating opportunities for direct interaction with potential clients. The registration process for webinars naturally captures lead information, while the content itself demonstrates expertise and builds trust with attendees.

Email Marketing and Lead Nurturing for Financial Services

Email marketing remains one of the most effective channels for financial services lead generation and nurturing. The key to successful email marketing in this sector lies in providing consistent value while building relationships over time. Financial decisions often require significant consideration, making long-term nurturing essential for conversion success.

Segmentation plays a crucial role in effective email marketing for financial services. Different client segments have varying needs, preferences, and decision-making timelines. Young professionals seeking basic financial planning services require different messaging and content than business owners looking for sophisticated wealth management solutions or retirees planning estate transfers.

Data-driven email marketing strategies can significantly improve lead generation results. By analyzing open rates, click-through rates, and conversion data, financial services companies can continuously optimize their email campaigns for better performance. Subject line testing, send time optimization, and personalization all contribute to improved engagement rates and higher lead conversion.

Marketing automation platforms enable sophisticated email nurturing sequences that guide potential clients through the decision-making process. These sequences can be triggered by specific actions or behaviors, ensuring that leads receive relevant content at the right time in their journey.

Social Media Lead Generation for Financial Services

Social media platforms offer unique opportunities for financial services lead generation, but success requires understanding the specific characteristics and user behavior patterns of each platform. LinkedIn stands out as the most effective platform for B2B financial services, while Facebook and Instagram can be valuable for reaching individual consumers and families.

LinkedIn lead generation strategies for financial services focus on building professional networks, sharing industry insights, and engaging with potential clients through valuable content and meaningful conversations. The platform’s advanced targeting capabilities allow financial advisors and companies to reach specific demographics, job titles, and industries with precision.

Content strategy on social media should focus on education and relationship building rather than direct sales. Financial services companies that consistently share valuable insights, market updates, and educational content tend to build larger, more engaged followings that generate steady streams of qualified leads.

Social media advertising can amplify lead generation efforts when used strategically. Platforms like Facebook and LinkedIn offer sophisticated targeting options that allow financial services companies to reach specific demographics with tailored messages and offers.

Search Engine Optimization for Financial Services

Search engine optimization (SEO) represents a critical component of successful financial services lead generation. Potential clients frequently begin their search for financial services with online research, making it essential for companies to rank prominently in search results for relevant keywords and phrases.

Local SEO is particularly important for financial advisors and smaller financial services companies that serve specific geographic markets. Optimizing for location-based searches like “financial advisor in [city]” or “investment services near me” can generate high-quality leads from prospects who are actively seeking local services.

Content optimization goes beyond simple keyword inclusion. Financial services websites must provide comprehensive, authoritative content that addresses the full spectrum of potential client questions and concerns. This approach not only improves search rankings but also establishes credibility with both search engines and potential clients.

Technical SEO considerations are crucial for financial services websites. Page loading speed, mobile responsiveness, and secure connections (HTTPS) all impact both search rankings and user experience. Given the sensitive nature of financial information, security considerations are particularly important for financial services websites.

Paid Advertising Strategies for Financial Lead Generation

Pay-per-click (PPC) advertising offers financial services companies the opportunity to generate immediate visibility and leads for specific services or target markets. However, successful PPC campaigns in the financial services sector require careful planning, precise targeting, and ongoing optimization to achieve acceptable returns on investment.

Google Ads campaigns for financial services should focus on high-intent keywords that indicate immediate need for services. Terms like “401k rollover,” “financial planning services,” or “business loan application” often generate qualified leads because they indicate specific, immediate needs.

Landing page optimization is crucial for PPC success in financial services. The landing page experience must align closely with the ad content and provide clear paths for lead capture. Trust signals, such as professional credentials, client testimonials, and security certifications, are particularly important for financial services landing pages.

Retargeting campaigns can be highly effective for financial services lead generation. Given the extended decision-making timeline common in financial services, retargeting allows companies to maintain visibility with potential clients who have previously visited their website or engaged with their content.

Conversion Rate Optimization for Financial Services

Optimizing conversion rates is essential for maximizing the return on investment from lead generation efforts. Financial services websites and landing pages must be designed and optimized to convert visitors into leads effectively while building trust and credibility.

Common conversion rate mistakes in financial services include overly complex forms, lack of trust signals, unclear value propositions, and poor mobile optimization. Addressing these issues can often result in significant improvements in lead generation performance.

Trust building elements are particularly important for financial services conversion optimization. Client testimonials, professional credentials, security certifications, and clear privacy policies all contribute to building the trust necessary for visitors to share their contact information and engage with financial service providers.

Form optimization involves finding the right balance between gathering necessary information and minimizing friction in the lead capture process. While financial services companies need specific information to qualify leads properly, overly long or complex forms can significantly reduce conversion rates.

Lead Qualification and Scoring for Financial Services

Effective lead qualification systems are essential for financial services companies to focus their time and resources on the most promising opportunities. Not all leads are created equal, and the ability to identify and prioritize high-value prospects can significantly impact overall profitability and growth.

Lead scoring models for financial services should consider multiple factors including demographic information, behavioral data, engagement levels, and expressed needs or interests. A sophisticated lead scoring system helps sales teams prioritize their follow-up efforts while ensuring that no qualified prospects fall through the cracks.

Demographic factors such as income level, age, occupation, and geographic location often play important roles in financial services lead scoring. However, behavioral indicators such as website engagement, content downloads, email interactions, and social media engagement can be equally or more predictive of conversion likelihood.

Regular review and optimization of lead scoring models is essential for maintaining effectiveness. As market conditions change and new data becomes available, scoring algorithms should be updated to reflect current reality and improve prediction accuracy.

Technology Integration for Streamlined Lead Management

Modern financial services lead generation relies heavily on technology integration to create seamless workflows and maximize efficiency. The ability to connect various tools and platforms creates opportunities for automation, improved data accuracy, and better lead nurturing.

CRM integration capabilities are particularly important for financial services companies that use multiple tools for lead generation, marketing, and client management. Seamless data flow between systems eliminates manual data entry, reduces errors, and ensures that all team members have access to current, accurate information.

Marketing automation integration allows for sophisticated lead nurturing sequences that can be triggered by specific actions or behaviors. This capability is particularly valuable for financial services companies because of the extended sales cycles and the need for ongoing education and relationship building.

Analytics integration provides comprehensive visibility into lead generation performance across all channels and campaigns. This data is essential for making informed decisions about resource allocation and strategy optimization.

Compliance and Regulatory Considerations

Financial services lead generation must always operate within the framework of applicable regulations and compliance requirements. These requirements vary by jurisdiction and specific service type but generally include considerations around privacy, data protection, marketing communications, and client suitability assessments.

Data privacy regulations such as GDPR and CCPA have significant implications for lead generation activities. Financial services companies must ensure that their lead capture processes, data storage practices, and marketing communications comply with all applicable privacy regulations.

Marketing communication regulations often impose specific requirements on how financial services can be advertised and promoted. These may include disclaimers, risk warnings, and restrictions on certain types of claims or promises.

Documentation and record-keeping requirements mean that financial services companies must maintain detailed records of their lead generation activities, including sources, communications, and outcomes. Robust CRM systems with comprehensive tracking capabilities are essential for meeting these requirements.

Measuring and Optimizing Lead Generation Performance

Effective measurement and optimization are crucial for maximizing the return on investment from financial services lead generation efforts. Key performance indicators (KPIs) should be tracked consistently, and regular analysis should inform ongoing optimization efforts.

Cost per lead (CPL) is a fundamental metric for financial services lead generation, but it must be considered alongside lead quality and conversion rates to provide meaningful insights. A lower CPL means nothing if the leads don’t convert into clients.

Conversion rate optimization should focus on the entire funnel, from initial awareness through final client onboarding. Lead conversion tracking capabilities provide insights into which channels and strategies produce not just the most leads, but the most valuable clients.

Lifetime client value (LCV) should be factored into lead generation ROI calculations. Financial services clients often have significant lifetime value, making it worthwhile to invest more in lead generation for high-value segments.

Advanced Strategies for Competitive Advantage

As the financial services market becomes increasingly competitive, companies must implement advanced lead generation strategies to maintain their edge. These strategies often involve sophisticated technology, innovative approaches, and deep understanding of client behavior and preferences.

Artificial intelligence and machine learning are beginning to play important roles in financial services lead generation. These technologies can analyze vast amounts of data to identify patterns, predict behavior, and optimize marketing campaigns in real-time.

Personalization at scale represents another advanced strategy that can significantly improve lead generation results. By using data and technology to create highly personalized experiences for potential clients, financial services companies can improve engagement rates and conversion performance.

Multi-channel attribution modeling helps financial services companies understand the complex customer journey and optimize their marketing mix accordingly. Given that financial decisions often involve multiple touchpoints across various channels, accurate attribution is essential for effective budget allocation.

Building Long-Term Client Relationships Through Lead Nurturing

Successful financial services lead generation extends far beyond initial lead capture. The development of long-term client relationships requires sophisticated nurturing strategies that continue well after the initial conversion.

Customer journey management involves understanding and optimizing every touchpoint in the client experience, from initial awareness through ongoing relationship management. This comprehensive approach ensures that clients remain engaged and satisfied throughout their relationship with the financial service provider.

Educational content continues to play an important role even after conversion. Clients who receive ongoing education and insights are more likely to remain loyal, refer others, and expand their relationship with additional services.

Regular communication and check-ins help maintain strong client relationships while potentially identifying opportunities for additional services. Automated reminder systems can help ensure that important client touchpoints are never missed.

Emerging Trends in Financial Services Lead Generation

The landscape of financial services lead generation continues to evolve rapidly, driven by technological advances, changing consumer behavior, and regulatory developments. Staying ahead of these trends is essential for maintaining competitive advantage.

Voice search optimization is becoming increasingly important as more consumers use voice assistants to search for information about financial services. This trend requires optimization for conversational queries and long-tail keywords.

Video marketing continues to grow in importance, with live streaming, interactive videos, and personalized video messages becoming more common in financial services marketing.

Social proof and user-generated content are playing increasingly important roles in financial services lead generation. Client testimonials, case studies, and success stories help build trust and credibility with potential clients.

Conclusion: Building a Sustainable Lead Generation System

Creating a successful lead generation system for financial services requires a comprehensive approach that combines multiple strategies, technologies, and best practices. The key is to build a system that not only generates leads consistently but also ensures high-quality prospects that convert into valuable long-term clients.

The most successful financial services companies view lead generation as an ongoing process rather than a series of isolated campaigns. This approach requires continuous optimization, regular testing, and adaptation to changing market conditions and client preferences.

Technology plays an increasingly important role in effective lead generation, but it must be combined with genuine expertise, authentic relationship building, and unwavering commitment to client service. SmartXCRM’s comprehensive CRM platform provides the tools and capabilities necessary to build and maintain a successful lead generation system for financial services companies of all sizes.

By implementing the strategies outlined in this guide and leveraging appropriate technology solutions, financial services companies can build sustainable competitive advantages while providing genuine value to their clients and prospects. The future belongs to companies that can effectively combine technological sophistication with authentic human relationships to create exceptional client experiences from the very first interaction.

The investment in comprehensive lead generation systems pays dividends not only in immediate business growth but also in long-term client relationships, referral generation, and sustainable competitive positioning. For financial services companies serious about growth, there has never been a more important time to optimize their lead generation strategies and systems.

Ready to transform your financial services lead generation? SmartXCRM offers comprehensive CRM and lead management solutions specifically designed for financial services companies. Our platform combines advanced lead generation tools, automated nurturing capabilities, and comprehensive analytics to help you convert more prospects into loyal clients. Contact us today to learn how we can help you build a more effective lead generation system./isolated-segment.html

Leave a comment: