Introduction to Loan Lead Generation CRM

In today’s competitive financial landscape, managing loan lead generation effectively has become crucial for Direct Sales Agents (DSA) and lending institutions. A robust loan lead generation CRM free solution can be the difference between struggling to convert prospects and building a thriving loan business. This comprehensive guide explores everything you need to know about loan DSA CRM, loan DSA software, and how to leverage loan CRM software for maximum success.

The financial services industry has witnessed unprecedented growth, with digital transformation reshaping how loan leads for DSA are generated, managed, and converted. Traditional methods of lead management are no longer sufficient to meet the demands of modern borrowers who expect instant responses, personalized service, and seamless application processes.

What is a Loan Lead Generation CRM Free Solution?

A loan lead generation CRM free system is a comprehensive customer relationship management platform specifically designed for the lending industry. Unlike generic CRM solutions, loan DSA CRM platforms are tailored to handle the unique requirements of loan processing, from initial lead capture to final disbursement.

Key Components of Loan Lead Generation CRM

Loan CRM software typically includes:

- Lead Capture Automation: Automatically capture loan leads for DSA from multiple sources including websites, social media, and referral partners

- Application Processing: Streamline loan applications with automated workflows

- Document Management: Secure storage and management of loan documents

- Communication Tools: Multi-channel communication capabilities for better customer engagement

- Analytics and Reporting: Comprehensive insights into lead performance and conversion rates

The beauty of a loan lead generation CRM free download is that it allows DSAs and small lending businesses to access enterprise-level features without significant upfront investment. This democratization of technology has enabled countless professionals to scale their operations efficiently.

Essential Features of Loan DSA CRM

1. Advanced Lead Management for Loan DSA

Effective loan DSA software must provide sophisticated lead management capabilities. The system should automatically categorize leads based on loan type, amount, credit score, and other relevant criteria. This segmentation allows DSAs to prioritize high-value prospects and tailor their approach accordingly.

Modern loan lead generation CRM solutions offer:

- Intelligent Lead Scoring: Automatically rank leads based on conversion probability

- Lead Source Tracking: Identify which marketing channels generate the highest quality loan leads for DSA

- Automated Lead Distribution: Ensure leads are assigned to the right team members instantly

- Lead Nurturing Workflows: Keep prospects engaged throughout the loan application process

2. Integration Capabilities

The best loan DSA CRM systems integrate seamlessly with existing business tools. This includes integration with:

- Banking Systems: Direct connectivity with lending partners and financial institutions

- Credit Bureau APIs: Real-time credit score checks and verification

- Document Verification Services: Automated document validation and processing

- Communication Platforms: WhatsApp, SMS, and email integration for multi-channel outreach

At SmartXCRM, we understand the importance of connectivity, which is why our lead management solutions are designed with extensive integration capabilities.

3. Compliance and Security Features

Given the sensitive nature of financial data, loan CRM software must prioritize security and compliance. Essential security features include:

- Data Encryption: End-to-end encryption for all customer data

- Access Controls: Role-based permissions to ensure data privacy

- Audit Trails: Complete tracking of all system activities

- Regulatory Compliance: Adherence to financial industry regulations and standards

Free Loan Lead Generation CRM Download Options

Understanding Free vs. Paid Solutions

When searching for a loan lead generation CRM free download, it’s important to understand the difference between truly free solutions and free trials of premium software. Most reputable loan DSA software providers offer free trials that allow you to test their full feature set before committing to a paid plan.

What to Look for in Free CRM Solutions

A quality loan lead generation CRM free solution should include:

- Basic Lead Management: Core functionality for capturing and organizing loan leads for DSA

- Contact Management: Comprehensive customer database with search and filter capabilities

- Task Management: Ability to set reminders and track follow-ups

- Reporting Features: Basic analytics to track performance metrics

- Mobile Access: Smartphone and tablet compatibility for field work

SmartXCRM’s Free Features

SmartXCRM offers a comprehensive loan DSA CRM solution with generous free features. Our platform includes essential tools for managing loan leads for DSA without requiring immediate payment. Users can experience the full power of our loan CRM software through our free lead generator tool designed specifically for small and medium businesses.

How Loan DSA Software Transforms Your Business

Streamlined Lead Processing

Traditional loan lead management often involves manual data entry, paper-based applications, and time-consuming follow-up processes. Loan DSA software revolutionizes this by automating routine tasks and creating efficient workflows.

With proper loan lead generation CRM, DSAs can:

- Reduce Processing Time: Automated workflows cut application processing time by up to 70%

- Improve Accuracy: Eliminate human errors in data entry and calculation

- Enhance Customer Experience: Provide faster responses and updates to loan applicants

- Scale Operations: Handle more loan leads for DSA without proportional increases in staff

Enhanced Customer Communication

Modern borrowers expect prompt, professional communication throughout the loan process. Loan CRM software enables:

- Automated Notifications: Keep customers informed about application status

- Multi-channel Outreach: Reach customers through their preferred communication channels

- Personalized Messaging: Tailor communications based on customer preferences and loan type

- Scheduled Follow-ups: Never miss important touchpoints with automated reminders

SmartXCRM’s communication automation features ensure that your customers always feel valued and informed throughout their loan journey.

Best Loan CRM Software Features

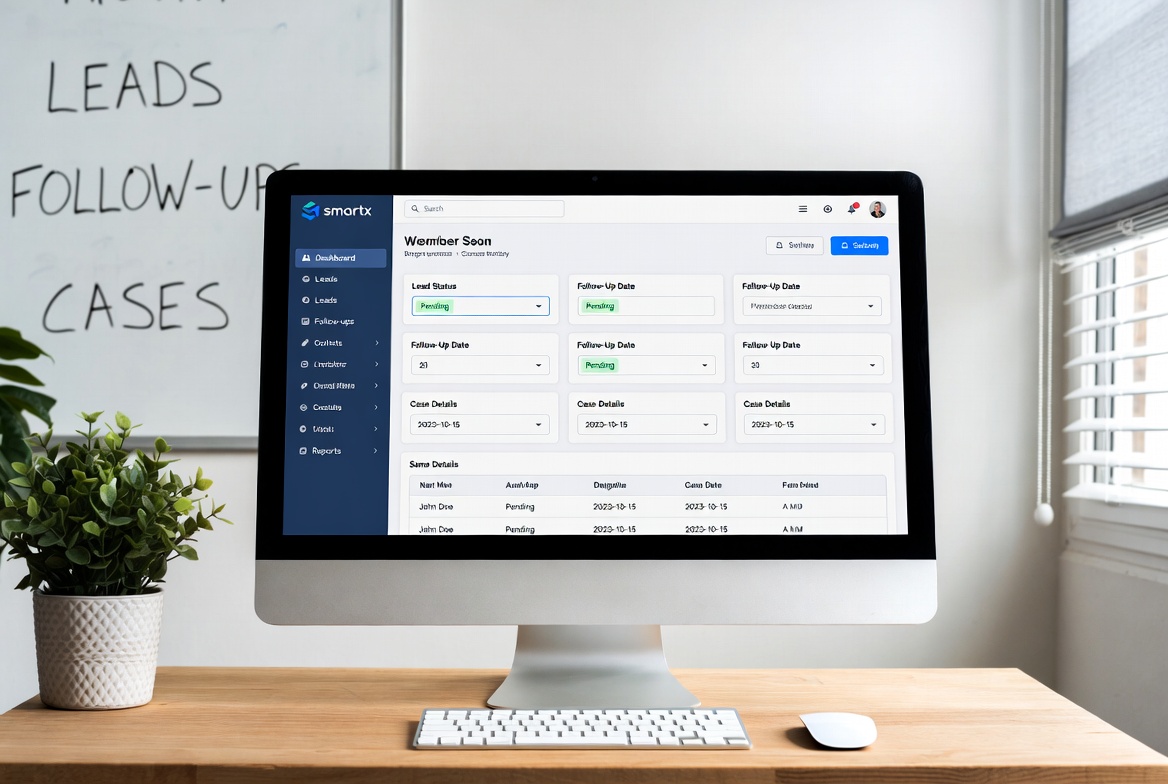

1. Comprehensive Dashboard

A well-designed loan DSA CRM dashboard provides instant visibility into key business metrics. Essential dashboard components include:

- Lead Pipeline Visualization: Track leads through each stage of the loan process

- Performance Metrics: Monitor conversion rates, average loan amounts, and processing times

- Team Performance: Compare individual DSA performance and identify top performers

- Revenue Tracking: Real-time revenue reporting and forecasting

2. Advanced Analytics and Reporting

Data-driven decision making is crucial for loan business success. The best loan CRM software provides:

- Custom Report Builder: Create reports tailored to specific business needs

- Trend Analysis: Identify patterns in customer behavior and market conditions

- ROI Tracking: Measure the effectiveness of different lead generation channels

- Predictive Analytics: Forecast future loan demand and revenue potential

3. Mobile Optimization

In today’s mobile-first world, loan DSA software must provide full functionality on smartphones and tablets. Mobile features should include:

- Offline Capability: Access customer information even without internet connectivity

- Document Capture: Use device cameras to capture and upload loan documents

- GPS Integration: Track field visits and optimize territory management

- Real-time Sync: Ensure all data is synchronized across devices instantly

SmartXCRM’s mobile-optimized platform ensures that DSAs can manage their loan leads for DSA effectively, whether they’re in the office or meeting clients in the field.

Managing Loan Leads for DSA Effectively

Lead Qualification Process

Effective loan lead generation CRM systems implement sophisticated lead qualification processes. This involves:

- Initial Screening: Automated evaluation of basic eligibility criteria

- Credit Assessment: Integration with credit bureaus for real-time score checking

- Income Verification: Tools for validating borrower income and employment

- Documentation Review: Automated document analysis and verification

Lead Nurturing Strategies

Not all loan leads for DSA are ready to apply immediately. Effective lead nurturing involves:

- Educational Content: Provide valuable information about loan products and processes

- Personalized Recommendations: Suggest appropriate loan products based on customer profiles

- Regular Follow-ups: Maintain contact without being overly aggressive

- Event-based Triggers: Respond to specific customer actions or milestones

Conversion Optimization

The ultimate goal of any loan DSA CRM is to convert leads into approved loans. Key optimization strategies include:

- A/B Testing: Experiment with different communication approaches and timing

- Process Improvement: Continuously refine application and approval workflows

- Customer Feedback: Regularly collect and act on customer feedback

- Performance Monitoring: Track conversion rates and identify improvement opportunities

Our experience at SmartXCRM has shown that proper lead nurturing can increase conversion rates by up to 300%. Our lead management system is specifically designed to maximize conversion potential.

SmartXCRM: Your Complete Loan DSA Solution

Why Choose SmartXCRM for Loan Lead Generation?

SmartXCRM has established itself as a leader in loan CRM software by focusing specifically on the unique needs of DSAs and lending professionals. Our loan lead generation CRM solution offers:

Specialized Features for Loan Professionals

- Loan-specific Workflows: Pre-built processes for different loan types (personal, business, home, etc.)

- Regulatory Compliance: Built-in compliance features for financial industry requirements

- Partner Integration: Direct connections with major lending institutions and banks

- Commission Tracking: Automated calculation and tracking of DSA commissions

Comprehensive Training and Support

Unlike generic CRM providers, SmartXCRM offers:

- Industry-specific Training: Onboarding programs designed for loan professionals

- Ongoing Support: Dedicated support team with financial services expertise

- Best Practices Guidance: Proven strategies for maximizing loan lead conversion

- Regular Updates: Continuous platform improvements based on industry feedback

Scalable Solution Architecture

Our loan DSA software is designed to grow with your business:

- Flexible User Management: Easily add or remove team members as needed

- Customizable Workflows: Adapt processes to match your specific business requirements

- Advanced Automation: Reduce manual work and focus on high-value activities

- Enterprise-grade Security: Bank-level security for all customer data

Success Stories with SmartXCRM

DSAs using SmartXCRM’s loan lead generation CRM have reported:

- 50% Increase in Lead Conversion: More efficient follow-up processes and better lead qualification

- 30% Reduction in Processing Time: Automated workflows and document management

- 40% Growth in Monthly Revenue: Better lead management and customer retention

- 90% Customer Satisfaction: Improved communication and faster service delivery

Implementation Guide

Getting Started with Loan Lead Generation CRM

Implementing a new loan DSA CRM system requires careful planning and execution. Here’s a step-by-step approach:

Phase 1: Assessment and Planning (Week 1-2)

- Business Requirements Analysis: Identify specific needs and pain points

- Current Process Audit: Document existing lead management workflows

- Integration Requirements: List all systems that need to connect with the CRM

- Team Preparation: Prepare your team for the transition to digital processes

Phase 2: System Setup and Configuration (Week 3-4)

- Account Creation: Set up your loan CRM software account and basic settings

- Data Migration: Import existing customer and lead data

- Workflow Configuration: Set up automated processes for lead management

- Integration Setup: Connect with external systems and partners

Phase 3: Training and Testing (Week 5-6)

- User Training: Ensure all team members understand the new system

- Process Testing: Validate that all workflows function correctly

- Data Validation: Verify that migrated data is accurate and complete

- Performance Tuning: Optimize system settings for best performance

Phase 4: Launch and Optimization (Week 7-8)

- Go-Live: Begin using the system for daily operations

- Performance Monitoring: Track key metrics and identify issues

- User Feedback: Collect feedback from team members and customers

- Continuous Improvement: Make adjustments based on real-world usage

SmartXCRM’s implementation team provides comprehensive support throughout this process, ensuring a smooth transition to your new loan lead generation CRM system.

Best Practices for CRM Implementation

Successful loan DSA software implementation requires:

Data Quality Management

- Clean Data Migration: Ensure all imported data is accurate and complete

- Standardized Formats: Establish consistent data entry standards

- Regular Data Audits: Periodically review and clean your customer database

- Duplicate Prevention: Implement systems to prevent duplicate lead entries

User Adoption Strategies

- Executive Sponsorship: Ensure leadership actively supports the new system

- Comprehensive Training: Provide multiple training sessions and resources

- Change Management: Help team members adapt to new processes and workflows

- Incentive Programs: Consider incentives for early adopters and power users

Performance Monitoring

- Key Performance Indicators: Establish metrics to measure CRM success

- Regular Reporting: Generate and review performance reports regularly

- Continuous Training: Provide ongoing education about new features and best practices

- System Optimization: Regularly review and improve system configurations

Benefits and ROI

Quantifiable Benefits of Loan Lead Generation CRM

Implementing a comprehensive loan DSA CRM system delivers measurable benefits:

Operational Efficiency Improvements

- Process Automation: Reduce manual tasks by 60-80%

- Response Time: Improve customer response times by 70%

- Data Accuracy: Eliminate 90% of data entry errors

- Document Management: Reduce document processing time by 50%

Revenue Growth Opportunities

- Lead Conversion: Increase conversion rates by 25-40%

- Customer Lifetime Value: Improve retention and repeat business by 35%

- Market Share: Capture more market share through better service delivery

- Competitive Advantage: Differentiate your services from competitors

Cost Reduction Benefits

- Administrative Costs: Reduce administrative overhead by 30-45%

- Training Costs: Streamline new employee onboarding

- Compliance Costs: Reduce regulatory compliance expenses

- Technology Costs: Consolidate multiple tools into a single platform

Calculating ROI for Loan CRM Software

When evaluating loan CRM software, consider these ROI factors:

Direct Cost Savings

- Staff Time: Calculate hours saved through automation

- Paper and Printing: Eliminate physical document costs

- Communication: Reduce phone and postage expenses

- Software Licensing: Consolidate multiple software tools

Revenue Enhancement

- Increased Conversions: Calculate additional revenue from improved conversion rates

- Faster Processing: Generate more revenue through quicker loan approvals

- Customer Retention: Value of retained customers over their lifetime

- Referral Business: Additional revenue from satisfied customer referrals

SmartXCRM clients typically see full ROI within 6-12 months of implementation, with continued benefits growing over time. Our CRM automation suite is specifically designed to maximize efficiency gains and revenue growth.

Future of Loan Lead Generation

Emerging Trends in Loan CRM Technology

The loan lead generation CRM landscape continues to evolve rapidly. Key trends shaping the future include:

Artificial Intelligence and Machine Learning

- Predictive Analytics: AI-powered lead scoring and conversion prediction

- Chatbots and Virtual Assistants: Automated customer service and lead qualification

- Risk Assessment: Machine learning models for improved credit risk evaluation

- Personalization: AI-driven personalized loan product recommendations

Digital Transformation Acceleration

- API-first Architecture: Seamless integration with emerging financial technologies

- Cloud-native Solutions: Improved scalability and reliability

- Mobile-first Design: Enhanced mobile experiences for both DSAs and customers

- Real-time Processing: Instant loan decisions and approvals

Regulatory Technology (RegTech)

- Automated Compliance: Built-in regulatory compliance monitoring

- Risk Management: Advanced risk assessment and mitigation tools

- Audit Automation: Streamlined audit processes and reporting

- Data Privacy: Enhanced data protection and privacy features

Preparing for the Future

To stay competitive in the evolving loan industry, DSAs should:

- Embrace Technology: Adopt modern loan DSA software solutions

- Focus on Customer Experience: Prioritize seamless, digital-first experiences

- Invest in Training: Continuously update skills and knowledge

- Build Partnerships: Collaborate with technology providers and lending partners

- Monitor Trends: Stay informed about industry developments and changes

SmartXCRM is committed to staying at the forefront of loan CRM software innovation. Our development team continuously incorporates the latest technologies and industry best practices into our platform.

The Role of Data in Future Loan Generation

Data will play an increasingly important role in loan lead generation CRM systems:

Advanced Analytics

- Customer Behavior Analysis: Deep insights into borrower preferences and patterns

- Market Trend Prediction: Forecasting changes in loan demand and market conditions

- Performance Optimization: Data-driven improvements to lead generation strategies

- Risk Modeling: Sophisticated risk assessment using multiple data sources

Integration Opportunities

- Open Banking: Integration with bank account data for better customer insights

- Social Media Intelligence: Leveraging social data for lead qualification

- IoT Data: Using connected device data for business loan assessments

- Blockchain Integration: Enhanced security and transparency in loan processing

Conclusion

The loan industry’s digital transformation has made loan lead generation CRM systems essential for success. Whether you’re looking for a loan lead generation CRM free solution or a comprehensive loan DSA software platform, choosing the right system can dramatically impact your business performance.

SmartXCRM’s loan CRM software provides everything DSAs and lending professionals need to succeed in today’s competitive market. From basic loan leads for DSA management to advanced analytics and automation, our platform delivers measurable results and sustainable growth.

Leave a comment: