The insurance industry is evolving rapidly, and insurance agents need powerful tools to stay competitive. InsureCRM by SmartXCRM represents the pinnacle of customer relationship management software designed specifically for insurance professionals. This comprehensive guide explores why InsureCRM stands out as the best CRM software for insurance agents and how it can revolutionize your insurance business operations.

What is InsureCRM? Understanding the Best Insurance CRM Solution

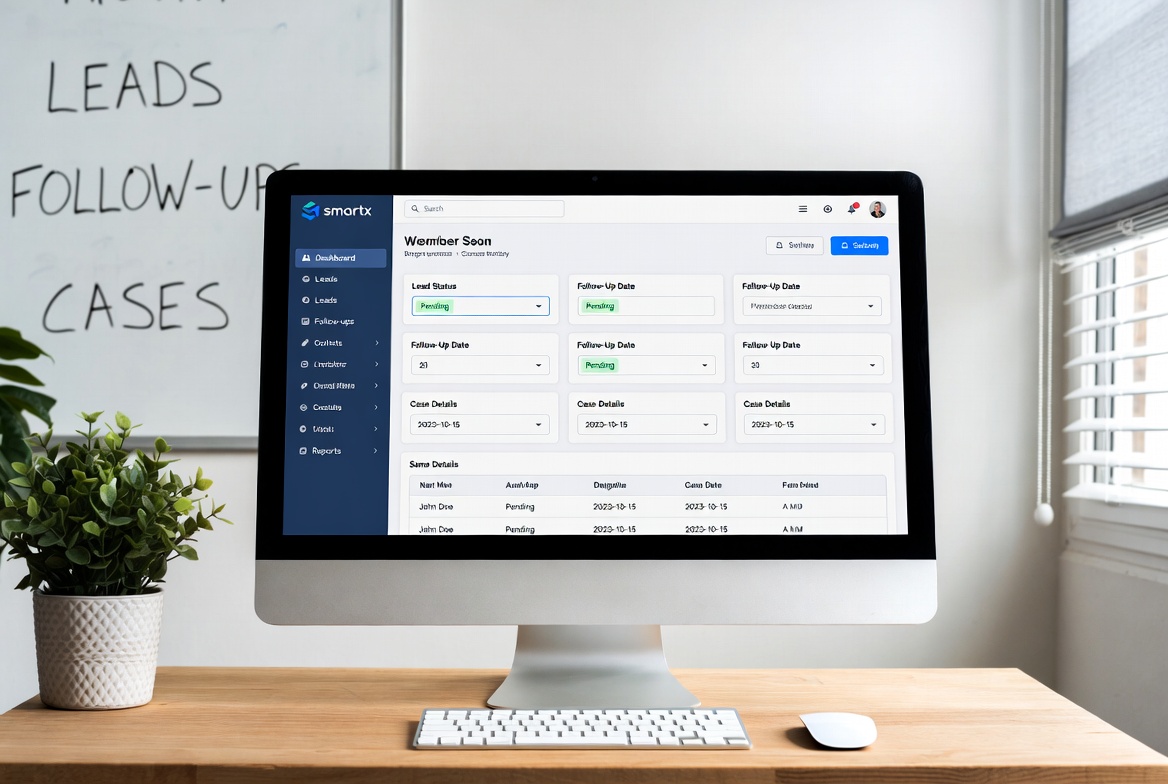

InsureCRM is a specialized customer relationship management platform developed by SmartXCRM, tailored specifically for insurance agents, brokers, and agencies. Unlike generic CRM systems, InsureCRM addresses the unique challenges faced by insurance professionals, from lead generation and client management to policy tracking and renewal automation.

Key Features That Make InsureCRM the Best CRM for Insurance Agents

Advanced Lead Management for Insurance Sales InsureCRM excels in lead management, offering insurance agents sophisticated tools to capture, track, and nurture prospects throughout the entire sales funnel. The system automatically categorizes leads based on insurance type, urgency, and potential value, ensuring no opportunity slips through the cracks.

Policy Management and Renewal Tracking One of InsureCRM’s standout features is its comprehensive policy management system. Insurance agents can track policy details, renewal dates, premium amounts, and client preferences all in one centralized dashboard. The automated renewal reminder system ensures clients receive timely notifications, significantly improving retention rates.

Client Communication Hub Effective communication is crucial in the insurance industry. InsureCRM provides multiple communication channels, including automated follow-ups via email, SMS, and WhatsApp. Insurance agents can maintain consistent contact with clients, building stronger relationships and increasing customer satisfaction.

Why Insurance Agents Choose InsureCRM Over Traditional CRM Solutions

Industry-Specific Customization

Unlike generic CRM platforms, InsureCRM understands the insurance industry’s unique requirements. The software includes pre-built templates for various insurance types, compliance tracking features, and integration capabilities with major insurance carriers and underwriters.

Superior Lead Generation Capabilities

InsureCRM incorporates advanced lead generation tools specifically designed for insurance agents. The platform can integrate with multiple lead sources, including social media campaigns, website forms, and referral programs, ensuring a steady flow of qualified prospects.

Automation That Actually Works

The CRM automation suite within InsureCRM eliminates repetitive tasks that consume valuable time. From automatic lead distribution to policy renewal notifications, insurance agents can focus on what they do best – selling insurance and serving clients.

InsureCRM vs. Traditional Insurance Management Methods

Moving Beyond Excel Spreadsheets

Many insurance agents still rely on Excel spreadsheets for client management. However, CRM vs Excel comparison clearly demonstrates why modern insurance businesses need sophisticated CRM solutions. InsureCRM offers real-time data synchronization, automated calculations, and collaborative features that Excel simply cannot match.

Comprehensive Customer Journey Management

InsureCRM excels at managing the complete customer lifecycle, from leads to loyalty. Insurance agents can track prospects from initial contact through policy purchase and ongoing renewals, ensuring consistent service delivery at every touchpoint.

Advanced Features of InsureCRM for Insurance Professionals

Intelligent Task Management and Reminders

The task and reminder system in InsureCRM helps insurance agents stay organized and productive. The platform automatically generates tasks based on client interactions, policy dates, and follow-up requirements, ensuring nothing falls through the cracks.

Data-Driven Decision Making

InsureCRM provides comprehensive analytics and reporting features that enable insurance agents to make informed business decisions. Track conversion rates, identify top-performing lead sources, and analyze client behavior patterns to optimize your insurance sales strategy.

Multi-Channel Lead Capture

Modern insurance clients interact across multiple channels. InsureCRM supports lead capture from websites, social media platforms, referrals, and traditional marketing channels. The system automatically assigns leads to appropriate agents and triggers personalized follow-up sequences.

How InsureCRM Transforms Different Insurance Specializations

Life Insurance Agents

Life insurance sales require building deep trust and maintaining long-term relationships. InsureCRM’s client profile system stores comprehensive information about family situations, financial goals, and life events, enabling agents to provide personalized service and identify cross-selling opportunities.

Health Insurance Brokers

Health insurance regulations change frequently, and clients need ongoing support. InsureCRM tracks policy changes, renewal dates, and compliance requirements, ensuring health insurance brokers can provide accurate, timely advice to their clients.

Property and Casualty Insurance

P&C insurance involves managing multiple policies, claims tracking, and risk assessment. InsureCRM integrates with major insurance carriers to provide real-time policy information and claims status updates, streamlining the entire process for both agents and clients.

Commercial Insurance Specialists

Commercial insurance deals often involve complex negotiations and multiple stakeholders. InsureCRM’s collaboration features enable commercial insurance agents to manage team communications, track proposal status, and coordinate with underwriters efficiently.

SmartXCRM: The Technology Behind InsureCRM

Cutting-Edge Development Approach

SmartXCRM brings years of software development expertise to the insurance industry. As a company that develops all types of CRM software, SmartXCRM understands the technical requirements and business challenges faced by insurance professionals.

Scalable Architecture

Whether you’re a solo insurance agent or manage a large agency, InsureCRM scales with your business. The platform handles everything from individual agent needs to enterprise-level agency management requirements.

Integration Capabilities

InsureCRM seamlessly integrates with popular insurance industry tools, including policy management systems, quote generators, and compliance platforms. This connectivity ensures your existing workflow remains intact while gaining powerful CRM capabilities.

Implementing InsureCRM: Best Practices for Insurance Agents

Setting Up Your Insurance CRM System

Successful InsureCRM implementation begins with proper system configuration. Define your lead categories, set up automated workflows, and establish clear processes for client communication. The platform’s intuitive interface makes setup straightforward, even for agents with limited technical experience.

Maximizing Lead Conversion Rates

InsureCRM includes features specifically designed to improve conversion rates. Automated follow-up sequences, personalized communication templates, and lead scoring algorithms help insurance agents focus on the most promising prospects while maintaining consistent contact with all leads.

Building Long-Term Client Relationships

The insurance business thrives on relationships. InsureCRM’s client management features enable agents to track important dates, preferences, and communication history, fostering stronger connections that lead to increased retention and referrals.

InsureCRM Success Stories: Real Results from Insurance Professionals

Increased Lead Conversion

Insurance agents using InsureCRM report significant improvements in lead conversion rates. The combination of automated follow-ups, personalized communication, and comprehensive lead tracking typically results in 30-50% higher conversion rates compared to traditional methods.

Time Savings and Productivity Gains

By automating routine tasks and streamlining client management processes, InsureCRM enables insurance agents to focus on revenue-generating activities. Most users report saving 10-15 hours per week on administrative tasks.

Enhanced Client Satisfaction

The platform’s comprehensive client management capabilities lead to improved service delivery and higher client satisfaction scores. Automated renewal reminders, personalized communication, and efficient claim support contribute to stronger client relationships.

Advanced InsureCRM Features for Growing Insurance Businesses

Team Collaboration and Management

For insurance agencies with multiple agents, InsureCRM provides robust team management features. Lead assignment capabilities ensure fair distribution of opportunities while maintaining accountability and performance tracking.

Marketing Campaign Integration

InsureCRM supports comprehensive marketing campaigns tailored for the insurance industry. Create targeted campaigns for different insurance products, track campaign performance, and nurture leads through sophisticated drip marketing sequences.

Analytics and Reporting

The platform provides detailed analytics on lead sources, conversion rates, and client lifetime value. These insights enable insurance agents to optimize their marketing spend, identify their most profitable activities, and make data-driven business decisions.

Comparing InsureCRM with Other Insurance CRM Solutions

Feature Comparison

While many CRM platforms claim to serve the insurance industry, InsureCRM stands out through its specialized features and insurance-focused design. The platform includes policy tracking, renewal management, and compliance features that generic CRMs lack.

Cost-Effectiveness

InsureCRM offers exceptional value for insurance professionals. The platform’s automation capabilities and productivity improvements typically result in ROI within the first few months of implementation.

User Experience

The insurance-specific interface design makes InsureCRM intuitive for insurance professionals. Unlike generic CRMs that require extensive customization, InsureCRM works effectively right out of the box.

Future of Insurance CRM: What’s Next for InsureCRM

Artificial Intelligence Integration

SmartXCRM continues to innovate, incorporating AI-powered features into InsureCRM. Predictive analytics, automated lead scoring, and intelligent communication optimization represent the next generation of insurance CRM capabilities.

Mobile Optimization

Modern insurance agents work from various locations. InsureCRM’s mobile optimization ensures full functionality across all devices, enabling agents to manage their business efficiently whether in the office, at client meetings, or working remotely.

Regulatory Compliance Updates

The insurance industry faces evolving regulatory requirements. InsureCRM automatically updates compliance features and reporting capabilities to ensure insurance agents remain compliant with current regulations.

Getting Started with InsureCRM

Implementation Process

Starting with InsureCRM is straightforward. The platform offers guided setup processes, data import tools, and comprehensive training resources to ensure quick adoption and immediate productivity gains.

Support and Training

SmartXCRM provides extensive support for InsureCRM users, including training sessions, documentation, and ongoing technical support. The company’s commitment to customer success ensures insurance agents can maximize their CRM investment.

Pricing and Plans

InsureCRM offers flexible pricing plans designed for different business sizes and needs. From individual agents to large agencies, the platform provides cost-effective solutions that scale with your business growth.

Conclusion: Why InsureCRM is the Best Choice for Insurance Agents

InsureCRM by SmartXCRM represents the future of insurance customer relationship management. With its industry-specific features, powerful automation capabilities, and comprehensive client management tools, InsureCRM enables insurance agents to build more successful, profitable businesses.

The platform’s combination of lead generation tools, policy management features, and client communication capabilities addresses every aspect of insurance sales and service. For insurance agents looking to modernize their operations, improve productivity, and enhance client relationships, InsureCRM offers an unmatched solution.

Whether you’re a solo agent looking to grow your business or manage a large insurance agency, InsureCRM provides the tools and features necessary to succeed in today’s competitive insurance market. The platform’s proven track record, continuous innovation, and industry-specific focus make it the clear choice for insurance professionals ready to transform their business operations.

Ready to experience the power of specialized insurance CRM software? Discover why SmartXCRM is the smart choice for modern businesses and see how InsureCRM can revolutionize your insurance business today.

Leave a comment: